INCOME TAX CALCULATOR

INCOME TAX CALCULATOR

FAQs

The following are some of the most frequently asked questions.

System requirements for installing TaxMode

TaxMode requires a PC running Windows with at least 2mb memory. It also requires Microsoft .NET Framework version 4 installed on your PC. This version of .NET may already be installed on your PC. Otherwise the installation program will provide you with a web link to install it directly from Microsoft. In such a case, accept the link to download and install .NET. After this installation, if required, go back to the TaxMode site and download the program.

Each results shown on the Result Display Window is fully supported

for its computations.

To display these details

point cursor over the amount (or its

caption) and click.

If you want a printout of this detail Press F10

Build the initial scenario with applicable data.

Press F4 (or select Static compare option from the menu)

Make data additions or modifications as needed. TaxMode will

compute and compare the results with the pre F4 scenario.

File

New Case

Build the new scenario. TaxMode will compute and compare the

results with the pre F4 scenario.

File

Load Case

Select the file of the case you want to compare. Upon loading

TaxMode will show the details and the bottom-line difference.

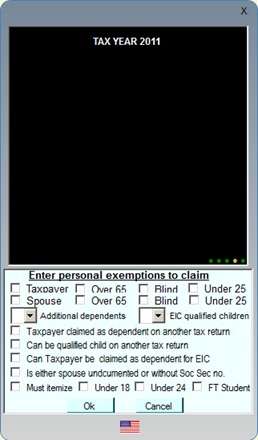

A number of details necessary for meaningful computation of taxes can be entered by clicking the Exemption button. This information is used in the computation of the amount of personal exemptions, Regular Tax, Alternative Minimum Tax and Earned Income Credit (EIC) if applicable.